FUELLED BY SCARCITY, THE ONLY WAY FOR LUXURY PENTHOUSE PRICES to Go IS UP

While the lower and mid-range sectors of residential real estate remain stagnant amid persisting global economic and geopolitical issues, the luxury segment is heating up due to an increase in overall global wealth and demand by investors to diversify their portfolios at home and abroad.

An inaugural report by Wealth-X and Sotheby’s International Realty documents the impact of ultra-high-net-worth individuals (UHNWIs) – defined as those with US$30 million or above in assets – on premium real estate. It reveals that UHNWIs own nearly US$3 trillion in residential properties and 79 per cent of them own two or more properties, with the secondary residence costing an average 45 per cent more than their primary home. Geographically, UHNWIs are increasing the number of properties they hold outside their home countries, with the US, UK, Singapore and Hong Kong being some of the favourites.

It is always difficult to assess the identities of the individuals who buy luxury real estate. A recent article by The New York Times, which examined the inflow of global cash propelling the high-end real estate market, found that nearly half of the most expensive properties in the US are purchased anonymously through shell companies, with nearly 40 per cent of them being international buyers.

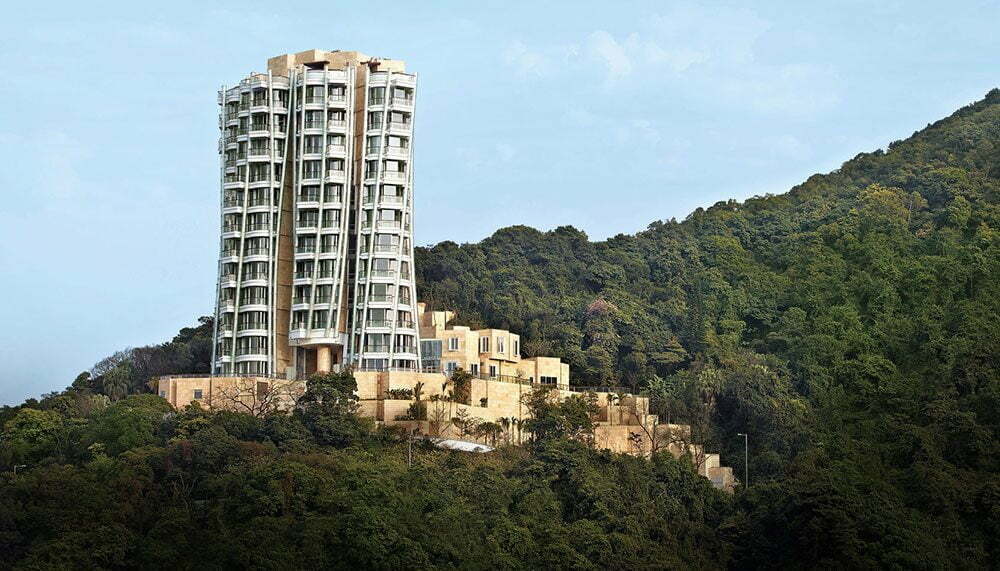

The reasons for investing in luxury property are manifold, with emotional value, tax regulations and practicality topping the list. As businesses of an international nature look to Asia for wealth creation, individuals are also increasing their presence in Asian and other emerging markets. They tend to prefer penthouses to suburban detached houses, thanks to the former’s vicinity to CBDs, land scarcity and lifestyle choices.

According to one of Thailand’s leading property development firms, Raimon Land, the way penthouses were built, sold and marketed a decade ago has changed radically over the years. While penthouses were previously seen as sizeable units occupying top floors of buildings with no luxuries such as private pools and elevators, buyers’ expectations have grown exponentially. The most expensive penthouses in the world now come with amenities and services such as an in-house caterer (Sky Penthouse in The Odeon Tower, Monaco, listed at US$400 million, bullet-proof windows and security by special forces (Hyde Park penthouse, London, US$237 million), and a yoga studio and pet grooming room (One 57 Winter Garden penthouse, New York, US$115 million).

These phenomenal prices are also part of the ever-evolving market. Previously, the price per square metre of a penthouse was lower than other units in the building because the larger space was considered to be more difficult to sell.

Nowadays, developers such as Raimon Land approach penthouses as a one-of-a-kind experience, be it through pricing, sizing, access, collaterals or distribution channels. Even the buyers are rigorously vetted and there are no listings – potentials are asked to make an offer, which is either accepted or rejected – an approach completely novel to the Thai property market at the time.

As a result, the smaller of the two penthouses at Raimon Land’s iconic 185 Rajadamri development was sold for the highest price per square metre ever achieved for a residential property in Thailand.

If this is any indication of where the market is headed, then the only way to go is up, literally.